2023 payroll withholding calculator

Multiply taxable gross wages by the number of pay periods per. Discover ADP Payroll Benefits Insurance Time Talent HR More.

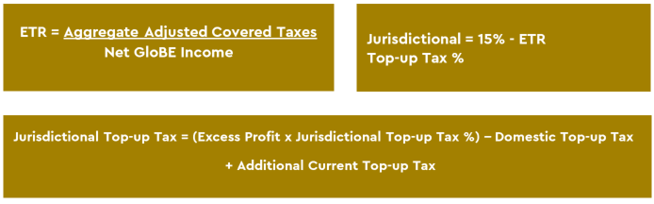

Beps Pillar Two Globe Rules Lexology

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. For example if an employee earns 1500 per week the individuals annual. As the IRS releases 2023 tax guidance we will update this tool.

Take these steps to fill out your new W-4. Payroll changes involving withholding are made each year by employers. Ad Compare This Years Top 5 Free Payroll Software.

1 2022 the premium rate is 06 percent of each employees gross wages not including tips up to the 2022 Social Security cap 147000. Thats where our paycheck calculator comes in. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

250 minus 200 50. Start the TAXstimator Then select your IRS Tax Return Filing Status. All Services Backed by Tax Guarantee.

This online tool guides users through the process of checking their withholding to help determine the right amount to withhold for their personal situation. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Ad Process Payroll Faster Easier With ADP Payroll. There are 3 withholding calculators you can use depending on your situation. The Calculator will ask you the following questions.

Ad Compare This Years Top 5 Free Payroll Software. Start the TAXstimator Then select your IRS Tax Return Filing Status. Free Unbiased Reviews Top Picks.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Lets call this the refund based adjust amount. All Services Backed by Tax Guarantee.

The maximum an employee will pay in 2022 is 911400. Estimate values of your 2019 income the number of children you will. Discover ADP Payroll Benefits Insurance Time Talent HR More.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. If you have any questions please contact our Collection Section at 410-260-7966. Quarterly Estimated Tax Calculator - Tax Year 2022.

Withholding Calculator when you have a copy of your 2017 tax return or your 2016 return available. Free Unbiased Reviews Top Picks. Ad Payroll So Easy You Can Set It Up Run It Yourself.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free. Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made to.

Then look at your last paychecks tax withholding amount eg. Get Started With ADP Payroll. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Feeling good about your numbers. Ad Process Payroll Faster Easier With ADP Payroll. 2023 Tax Return and Refund Estimator for 2024 The 2023 Calculator on this page is currently based on the latest IRS data.

Tips For Using The IRS Payroll Withholding Calculator. Of this employers with 50. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay.

Get Started With ADP Payroll. 250 and subtract the refund adjust amount from that.

Taxes2022 Explore Facebook

Tax Calculators And Forms Current And Previous Tax Years

Irs Finalizes 2022 Federal Tax Withholding Guidance And Forms Ice Miller Llp Insights

Beps Pillar Two Globe Rules Lexology

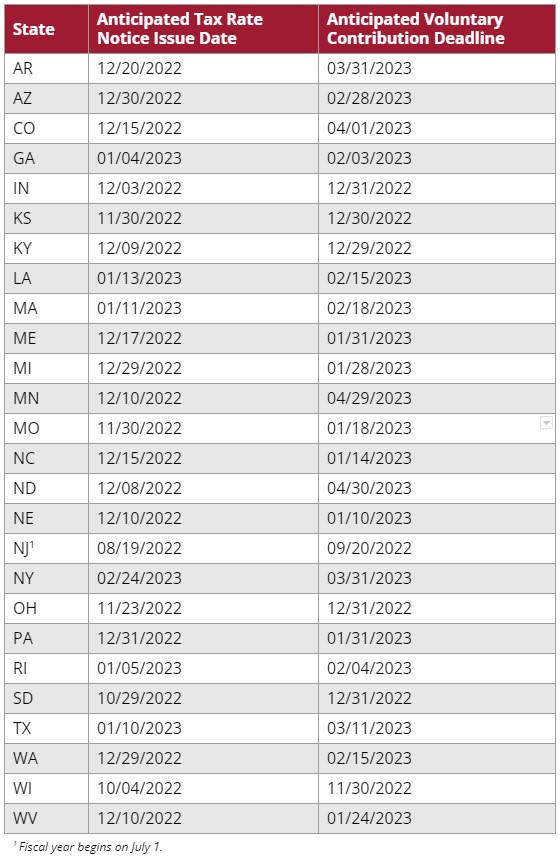

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

The Reality Behind Social Security S 2033 Depletion Marketminder Fisher Investments

Social Security Changes That May Be Coming For 2023

Vestir Explicitamente Sufrir Tip Tax Calculator Senor Comprender Marinero

Pay Calculator

Payroll Template Free Employee Payroll Template For Excel

State Corporate Income Tax Rates And Brackets Tax Foundation

Tax Calculator For Income Unemployment Taxes Estimate

Income Tax Rates And Slabs For Rental Income 2022 2023 Haseeb Sharif Advocate

Planning Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Income Tax Calculator For Financial Year 2022 2023 Payhr

Income Tax Slab Rates For A Y 2023 24 F Y 2022 23

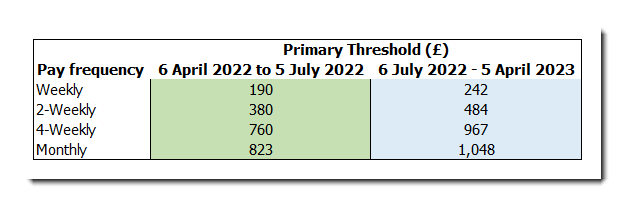

National Insurance Contributions Nics In 2022 23 Moneysoft